Latest News

Research News RSS Feed

Q&A: Can weight loss drugs help in addiction treatment?

April 11, 2024

American studies students receive Graduate School awards

April 05, 2024

Fungi into the future

January 29, 2024

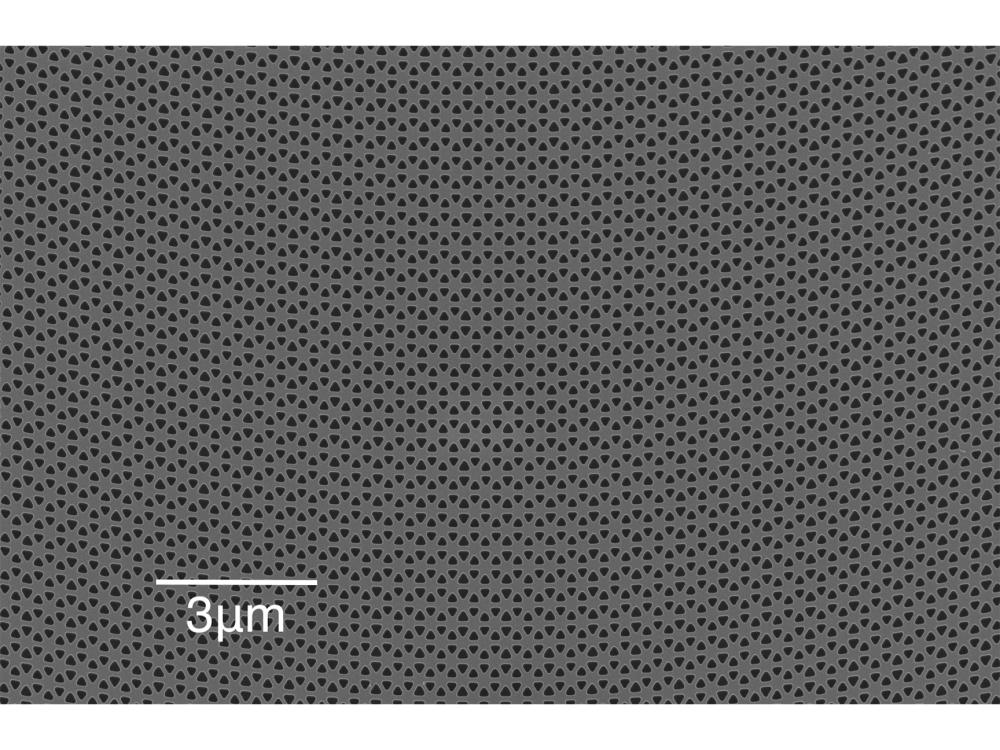

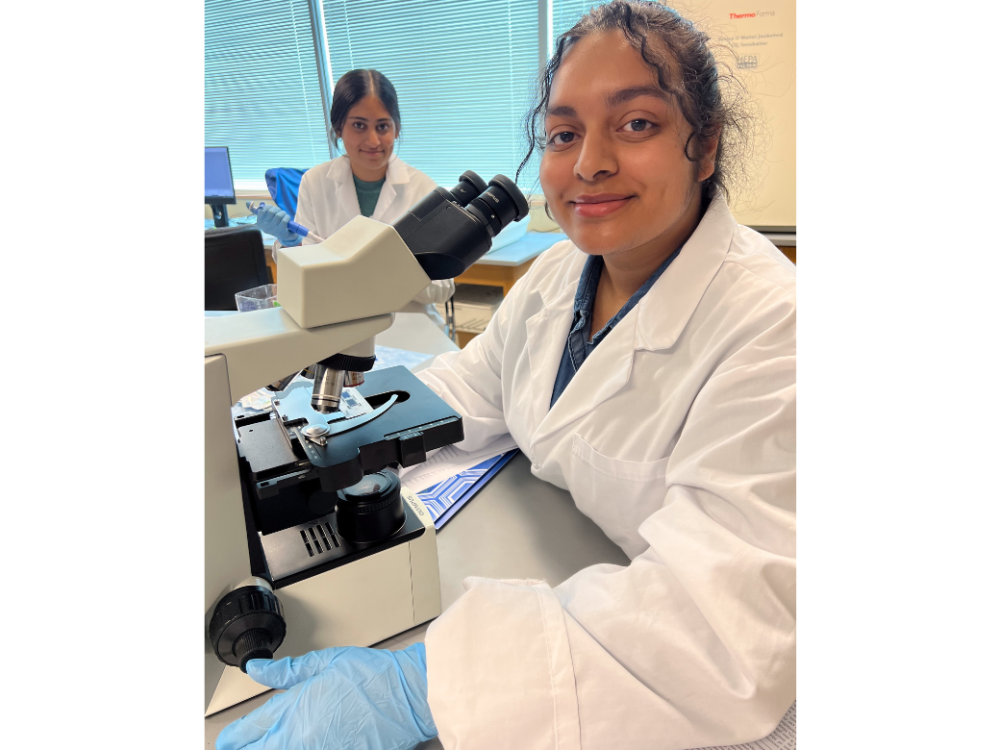

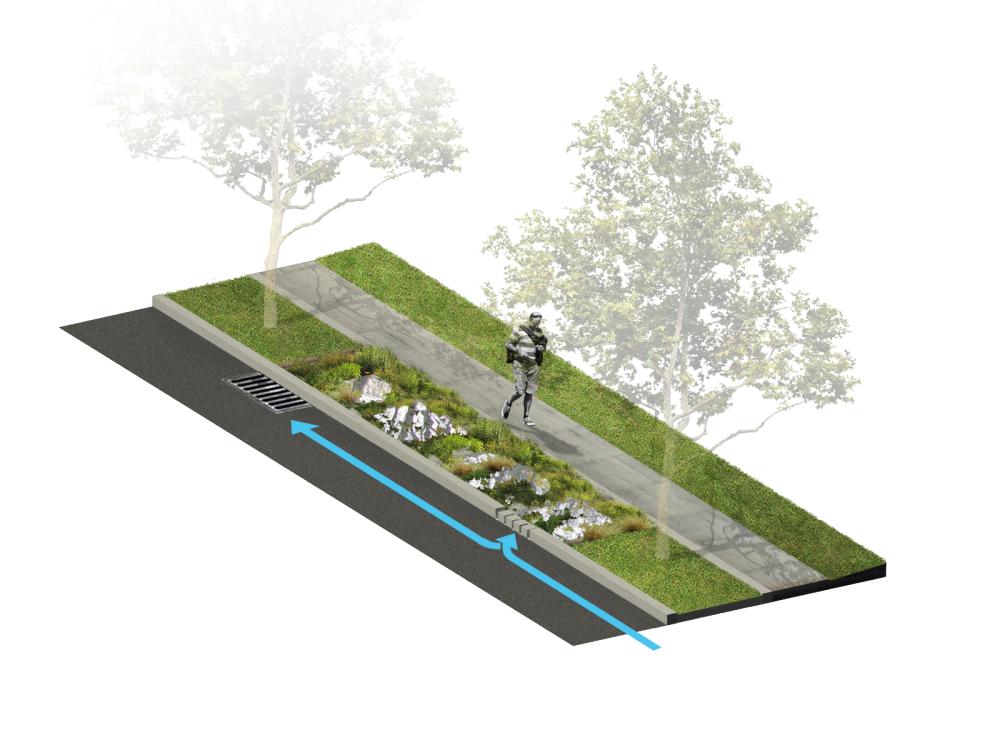

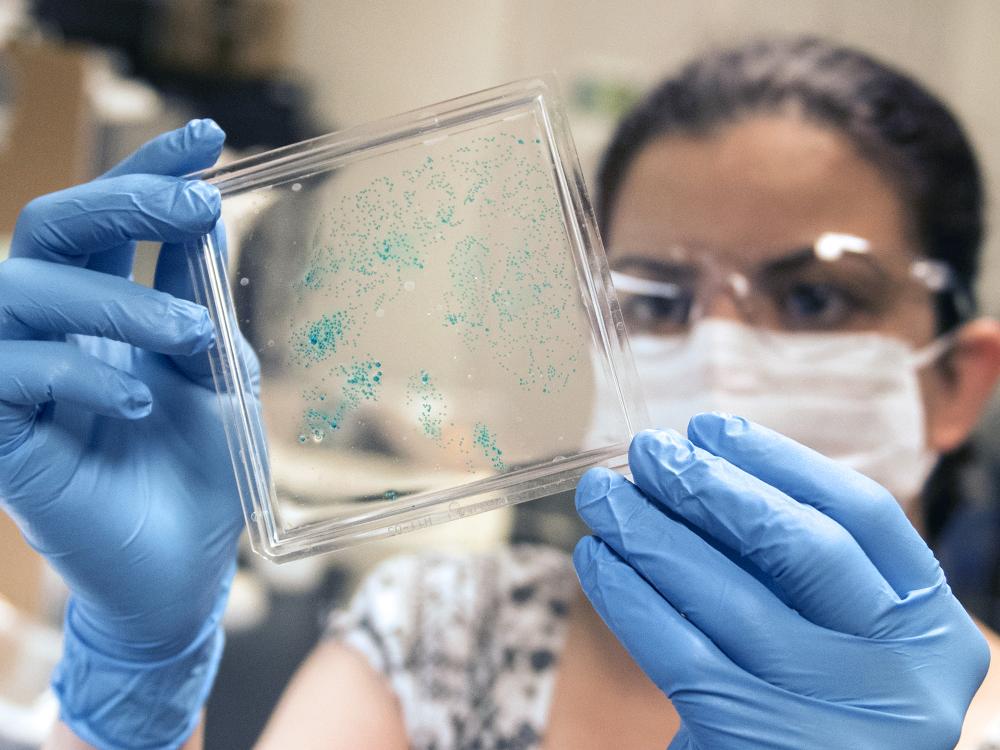

Sounding the alarm on microplastic pollution

February 06, 2023

Latest News

Research News RSS Feed

Q&A: Can weight loss drugs help in addiction treatment?

April 11, 2024

American studies students receive Graduate School awards

April 05, 2024

Fungi into the future

January 29, 2024

Sounding the alarm on microplastic pollution

February 06, 2023

Get the news by email

Subscribe